We invited Patrick McKenzie to talk about the business side of writing during our 2021 Substack On! conference. Below, you’ll find Patrick’s insights on business matters such as:

Which type of business to form (sole proprietorship, LLC, or corporation)

How to manage your business banking and bookkeeping

Calculating your revenue and expenses

Whether to get an insurance policy

Patrick (@patio11 on Twitter) is a writer who’s run 4 software businesses over 15 years. He works at Stripe and helped grow Stripe Atlas, an online platform that helps you start a business.

This transcript has been lightly edited for length. You can watch Patrick’s full talk in the video below.

Takeaways

Decide which type of business is right for you. Sole proprietorships, LLCs, and corporations vary in terms of maintenance, liability, and costs. Patrick recommends typically starting with a sole proprietorship, then transitioning to an LLC as the business grows.

Get an accountant, and keep detailed records of income and expenses. You can track your subscription revenue on Substack. Use a folder to collect receipts for expenses that are not recorded electronically.

Set up a business bank account, or a separate personal bank account. Having a dedicated bank account for your business makes it easier to know what money is going in and out.

Deduct expenses that are necessary and customary to your business. Business expenses get paid out of your business's pocket, rather than yours.

Consider getting an insurance policy. A professional can handle any legal situations and give you peace of mind.

How I learned about business

I’ve run software businesses over the internet for about 15 years. Depending on how you count them, I ran about four businesses. In 2016, I joined Stripe to help work on Atlas. And I'm an internet writer just like you. I've written more than 3,000,000 words on the internet. For those of you who don't have this memorized, the Harry Potter series is about 1,050,000.

I don't say this to brag. I'm a very small fish in a very big sea that is the internet. I just want to say that I understand the terror of waking up in the morning and staring at a blank page. And I know what drives this business forward and what doesn't.

When we talk about the back office as businesses, I love this stuff more than is healthy. I've helped several thousand businesses incorporate either as a C corp or an LLC.

None of that is important to your business. Almost all of the value that you create in your business will be created by one of three things:

Writing better

Exposing that writing to more people

Getting more people to pay for the writing

You should consistently spend more than 90% of your time, your emotional energy, and your intellectual cycles on those three topics, and not the stuff that we're about to talk about. If you consistently find yourself spending more than 10% of your time on taxes or talking to bookkeepers, you should probably reevaluate your priorities or systems so that you're spending the appropriate amount of time on this.

I'm going to try to give you formulas that will set you up for success so that you spend the minimum amount of time on this stuff – to keep yourself legal, allow yourself to sleep well at night, and then get back to writing.

I've written about three million words on the internet, and the first two created the vast majority of the value. Those two words are: charge more. If you remember nothing else, remember that.

Charge more. If you remember nothing else, remember that.

Anytime you are considering price points as an internet creator, you are probably devaluing your own work, because you’re the expert on your topic, so it seems easy to you. It isn't easy for your readers. That's why they come to you as their trusted voice on whatever it is that you do.

This was the most important bit of advice that I ever got when I was starting my business, and it led directly to the success of it. I've repeated this to tens of thousands of engineers over the years – in their salary negotiations, in pricing software, and in pricing intellectual property that isn't software, such as online downloadables, e-books, newsletters, and Substacks. This advice is basically the auto-win. Charge much more than you're comfortable with.

Also, I am not a lawyer. I am not an accountant. Nothing that I tell you should be considered advice. I'm going to be addressing a younger version of me, trying to have him not make the mistakes that I actually did over the last 15 years.

Determining the size and type of your business

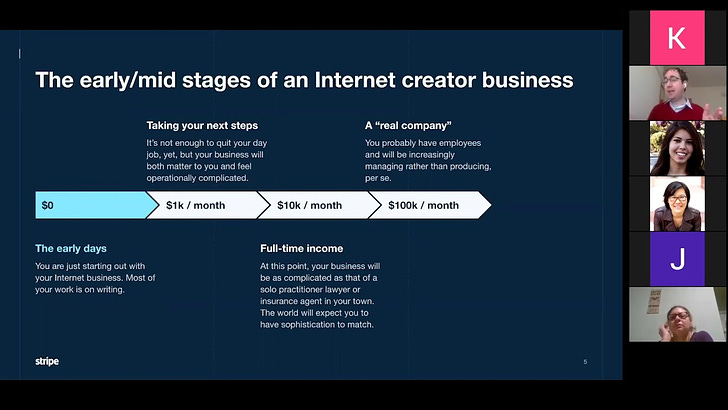

I'm addressing most of my comments to people who are writing perhaps casually or semi-professionally on the internet, but not yet making a lot of money. Your business is going to evolve over the years as you go from where you are right now.

The business tends to feel very different when it makes no money, versus when it is making about $1,000 a month. $1,000 a month is not nearly enough to quit the day job, but you start to spend a material amount of your time on business administration. It's enough money to actually feel it in your life. For me, that was my rent check every month. You start to see glimmers of, “Wait, there could actually be a future in this.”

Then, at about $10,000 a month, you probably have enough to quit your day job and make a pretty good go of it. The rest of the world starts looking at you and says, “That thing you have looks a little less like a side hustle, a little less like running a bake sale. That looks a little more like a business. You should probably be a responsible business and do things like making sure your books are ready for tax season and keeping things in your own name, getting insurance, and so on.”

And then at about $100,000 a month, you will be a real business in every possible sense of the word. You will likely have employees. Your relationship with those employees is going to dominate your time spent on the back office of the business. I was at the cusp of this when I sold my businesses and went off to do other things.

The things I would tell the “younger me” with regards to these topics is going to be contextualized along this spectrum, so that I’d understand which are appropriate investments of effort if I'm early in my career, versus which are best saved for later chapters.

Let's talk about forming a business. There are, broadly speaking, three common organizational forms for internet businesses. The two most common for internet creators are sole proprietorships and LLCs, or limited liability companies.

Sole proprietorships: the easiest to start with

Sole proprietorships will be most common by far – they are what you default to it as soon as you try to do something with the goal of making money.

You don't have to file a form anywhere. The first acknowledgement that that is a thing in the world would probably happen on your taxes next year. But as soon as you form that intent in your mind, boom, you are a sole proprietorship. So, they're very easy to start. A sole proprietorship is you just operating as a business.

A sole proprietorship is you just operating as a business.

The benefit of a sole proprietorship is that they're extremely easy to understand, because again, it's just you operating as a business. They have broadly simple tax forms and administration. They have minimal running costs. If you do it all yourself and pay with a sweat equity, it literally costs $0 a year to run a sole proprietorship. If you pay a tax accountant to help you file your taxes next year, it will cost you a few hundred dollars.

The downsides to a sole proprietorship are, largely, liability for the debts of the business and for any legal liabilities of the business.

Again, a sole proprietorship is you. When the business owes someone money, you owe someone money. If the business isn't doing well, you still owe someone money. If the business gets sued, you just got sued. If you own a house and the business got sued, your house is on the line. That’s the biggest reason why people graduate from sole proprietorship to some other form of organization.

LLCs: limited liability, more maintenance

The most common one that people graduate to is a limited liability corporation.

A limited liability corporation is established with your state. There's trivial paperwork to file. You can pick any state in the United States. It doesn't have to be the one that you are physically a resident in or doing work from. They're relatively simple to start. These days, getting an LLC spun up is about as easy as buying a book from Amazon. You just type some stuff into computer form and hit go. They have broadly simple tax administration, and annual administrative requirements.

The LLC does have limited liability. Your professional advisors would caveat that with, “If you do it right.” But if you set things up correctly, the assets and activities of the LLC are firewalled within the LLC. So if you, as the owner of the LLC, who works for the LLC, happens to have a house, the depths and the liabilities of the LLC should in most cases not be able to come after those.

If you set things up correctly, the assets and activities of the LLC are firewalled within the LLC.

As for downsides, it takes about a couple of hours to set up an LLC the first time – one day if you're trying to teach yourself what an LLC is at the same time as you're going through the setup process, or plausibly an hour if you use Stripe Atlas, which I'll tell you a little bit about later.

And there are some costs to running an LLC. Much of that is going to be spent on your tax preparation and bookkeeping.

If you're willing to pay with sweat equity and do your own taxes and do your own bookkeeping, it'll probably be in the hundreds of dollars, depending on where you live in the United States, because different states have different recurring annual costs for LLC.

Corporations: expensive and complicated

For completeness, I will tell you that corporations and S corporations are a thing in the world. The only reason someone will suggest that an internet business like yours, with a single person at the helm, adopt the corporation as a media operation, is to enable some tax gamesmanship.

Many small business accountants will talk about this exact form of gamesmanship. I think it's largely a waste of your time. It only matters if you make a very narrow range of income between $100,000 a year and $200,000 a year and you're willing to do some tax gamesmanship.

Accountants will give this advice because a lot of doctors specifically find themselves in exactly that bracket. A doctor has a finite number of hours to sell a year, so they have nothing that will move their needle by $10,000 except doing tax gamesmanship.

You, however, have a very easy way to move your needle. It is to write more, get in front of more people, and get more of them to pay you money. I think that is always a better time versus trying to do tax gamesmanship.

Similar to an LLC, a corporation has limited liability. Some people like owning a corporation because they feel like they're cool now as a result.

I think that's a rather silly hobby to have. But some people go to the opera every year. Some people join a golf club. Some people have a corporation in their back pocket. If that's you, you do you. I've never actually owned a corporation. LLCs have been fine. And LLCs scale to the moon – Apple in Japan is an LLC. It's amazing.

Corporations are relatively expensive and complicated to maintain every year: a couple thousand dollars, even if you're doing it exactly right. There's some corporate forms that you'd have to observe depending on your state, like having board meetings, which you have to get right. And if you're not a lawyer and don't have a lawyer in the room, you are highly unlikely to get right the first time.

Which business type is right for you?

“Younger me” would say that, in the early days of my business, prior to having any significant money coming in, I'd automatically do a sole proprietorship.

As money starts to come in, and I see a real future through this business, I would consider transitioning to an LLC. Actually, historically, I ran my businesses as a sole proprietorship for seven years. I think my peak was about $85,000 a year of revenue prior to actually forming the LLC.

The only reason I formed the LLC was that I had four businesses. One of my businesses was going into a regulated industry. I thought, “It's possible to screw things up in a regulated industry. That might cause that business to close. That would also cause me to lose everything I’ve built in my other businesses and my retirement account.” So, that’s why I finally broke down and formed an LLC.

These days, it's easier to form an LLC via things like Stripe Atlas. I might have formed one a bit earlier. But again, I ran a sole proprietorship in the United States for seven years and had no problems.

Sole proprietorships are by far the most common business in the United States, something like 96% of all businesses. Don't quote me on that number, but it's astounding how many there are. And many, many successful internet businesses are running sole proprietorships. It might not be optimal, but that is the way of the world.

Many successful internet businesses are running sole proprietorships. It might not be optimal, but that is the way of the world.

As you get to $100,000 a month of revenue, you're probably going to have employees and things. You're definitely a real company, but you can stay as an LLC.

I would definitely not have a full-time employee as a sole proprietorship, even though one is theoretically allowed to, because they are a source of risk for the business. There could be litigation around employment practices. They could have a dispute with you about payroll. If in the fifth year of dealing with an employee, you have an irreconcilable difference of opinion and need to fire them and they talk to a lawyer, you do not want your house on the line.

So, definitely speak to your professional advisor about whether you should have an LLC before you formally bring someone on as an employee.

Definitely speak to your professional advisor about whether you should have an LLC before you formally bring someone on as an employee.

There are many ways to form an LLC online. You can probably form one through your state directly. Stripe Atlas, which I worked for for three years, does LLC formation. If you go to this link, you can get $250 off your LLC formation. We'll also throw in the registered agent, which is a detail that you need to worry about (but don't worry about it too much for the first year).

Don't rush out to form an LLC today. Form it when it is right for you, but we're standing by if you need it. And again, there are many LLC providers. I happen to think the one I work for is the best, but feel free to go with whatever works for your needs.

Bookkeeping for your business

“Let's talk about the scintillating topic of bookkeeping,” said no one ever. But bookkeeping, if you do it right, is going to save you a lot of time and frustration on your taxes next year. I want to share a few quick tips, which will save you a lot of money down the line.

The main thing that internet businesses use bookkeeping for is supporting your tax filing next year. So, let’s work backwards from that goal. What is the tax going to look like for a sole proprietorship or an LLC? It's going to look like Schedule C. Or if you want to play life in easy mode, Schedule C-EZ.

The Schedule C looks a little bit intimidating, but it's really not if you zoom in on just the two parts that matter, which is 1) income, and 2) expenses.

Income is really simple. It's how much money came into the business from customers. That's just the total of everything that you charge your customers via Substack. So it will be a very easy number for you to calculate.

Expenses are also relatively easy. It's how much was spent on the business specifically.

The one wrinkle here is that you need to be able to substantiate everything that goes on the Schedule C. “Substantiate” is a big word that the IRS uses to mean proof. And what they mean is you need contemporaneous written or electronic records about every transaction that backs something that goes on the Schedule C. You are automatically going to have that for all the money coming into the business, because no one is paying you physical cash to buy your Substack. They're all using a credit card. It goes through Substack, and Substack keeps records for you. Boom, you're done.

As you get closer to actually making money, you're going to have to file taxes next April. The bookkeeping is going to be by the “shoebox at the end of the year” method. This is called a “shoebox” in the industry because the typical entrepreneur comes in with a shoebox of receipts.

What I mean is that you're not going to be doing bookkeeping on a monthly basis for yourself. Set up a system to capture all of the information contemporaneously, and you’ll review that information with your professional advisor next year.

If you have a full-time income from running your Substack business, you are probably going to want to have this happen on sort of a monthly basis with a check-in for the bookkeeper, just so you are keeping enough money to pay for things like quarterly taxes.

There are a couple options here. I use a service called Bench. I won't say it's expensive, but they don't need to be told to charge more. It costs me about $150 a month, which would have been prohibitive for me when I was just starting out. It makes a lot of sense at my scale and given that I've got other things going on in life. You can do your own bookkeeping in something like Xero.

You are a much better author than you are a bookkeeper. Let somebody else do the bookkeeping for you. Just go sell more subscriptions.

I would tell you that you are a much better author than you are a bookkeeper. Let somebody else do the bookkeeping for you. Just go sell more subscriptions.

You can hire a freelance bookkeeper. They are available abundantly on the internet in every town in America and they charge not all that much money, because it's a great job to do when you work from home. As your business gets more sophisticated, this does get a little more complicated. You'll want things like tax structuring, retirement, and having an accountant on retainer. You can deal with that years from now.

Get a dedicated bank account

In the early days, get a dedicated checking account. It doesn't necessarily have to be in the name of the business. Again, as a sole proprietorship, you are the business. But you want all your business transactions to happen with one checking account because it will make life much easier for your bookkeeper or accountant to reconstruct what happened later.

It's also good for privacy. Hypothetically, think of all the things that could happen this year. You could get into a car accident. You could pay medical bills. You and your significant other could split up. There could be messiness around who is moving money in or out.

Do you really want to be talking about all of that with your bookkeeping person, when you’re doing your taxes next year? No, you don't. You just want to give them one account and say “Everything on this is for the business by default. I screwed up two times during the year and bought a latte for myself. Here they are. That is all that you need to know about my personal life: that I had two lattes.”

Put all of the payments from Stripe and Substack into that checking account, which is a trivial setting, and it's documented in Substack. Pay for business expenses using either the debit card attached to that account, or a credit card that is used only for the business and for nothing else. Luckily, banks give out credit cards like candy. It doesn't necessarily have to be a business credit card. Again, you are the business – just make it for the exclusive use of the business.

Pay for business expenses using either the debit card attached to that account, or a credit card that is used only for the business and for nothing else.

In terms of banking – because you’ve got to get paid – there's only one thing you need to know, which is a dedicated account for the business. I use Mercury for my LLC, and they treat me great.

The other option is to use the bank that you already bank out of for your personal needs. Again, get a new account for it. You can either get a business bank account or just another personal bank account to start out. You don't need to give them any reason for wanting another personal bank account – they'll just assume that you like having bank accounts.

Getting a new account at the same place as your personal banking will make transfers between your business and yourself substantially instantaneous, and that's helpful when you’re early in the life of a business and don't tend to keep a lot of cash around. That is literally everything you need to know about banking.

Calculating your revenue

Revenue is everything that you charge customers in the business. Depositing your own money into the business isn't revenue. You don't pay taxes on that. Revenue also includes things that are deducted before the revenue gets to you.

For example, if I have $100 of Substack subscriptions in a month, the actual amount of money that's going to hit the bank account is going to be approximately $86, because Substack will take their fee of about $10 dollars and Stripe will take our fee of about $4. So, did you have $86 of revenue? No, you did not. You had $100 of revenue and $14 of payment expenses.

Why does that matter? It doesn't matter because of net impact on your taxes. You had $86 of profit, and you will pay taxes on whatever part of that $86 wasn't hit by other expenses, but Substack and Stripe have an obligation in American law that if you process a certain amount of credit card transactions through them, they have to send the IRS an informational return for all the revenue that you processed during the year.

Let’s talk in larger numbers, because this is where the IRS will start to care about. If you come to the end of the year and sent the IRS a form that said they processed $100,000 transactions on us, and you told the IRS, “I have $86,000 in revenue this year,” then the IRS is going to say, “Oh, I know that isn’t true. I have this piece of paper that says you got at least $100,000 in this business. So, my first assumption is you are hiding $14,000 of taxable income.”

The IRS will send “younger me” a letter, and that letter will be absolutely freaking terrifying. What actually happens as a result of that letter is a couple of weeks of sleepless nights. Then you get on the phone with the accountant, who gets on the phone with the IRS.

It’s a simple mistake that happens all the time and gets dealt with – you owe a little bit of money to the accountant, and the IRS could end up not assessing any fees or penalties for your simple clerical error, but it will be weeks of sleepless nights, so don't do this.

Recording your expenses

On the expenses part, set up your life such that you capture most of the expenses automatically onto some electronic record. I'm going to tell you about how to do that in a minute.

If you don't pay the expense electronically – such as paying in-person or via cash – I have a quick thing to introduce you to. My best friend as a business owner is a folder with a zipper on top of it. You can buy 10 of these for $2 on Amazon.

The other day, I took somebody out to coffee to discuss the thing that he does. And of course, I paid for the coffee because I'm a nice business owner. I paid for it in cash. I got a receipt for $18. I wrote what this thing was on the date that I had the coffee. And I put it into my magic folder and zipped the folder back again. And by this simple magic, that $18 receipt becomes $10 in my pocket on Tax Day, because that's the marginal impact on my taxes given the tax rates in Japan. I'll explain the math later, but it's exactly the equivalent to putting $10 in my pocket 15 months from now. Everybody should have a folder.

There are some details. You don't have to memorize all these details. I just want to give you some words to remember so that you can talk to them with your bookkeeper, accountant or IRS-enrolled agent next year.

You can only deduct expenses which are necessary and customary to the business. Many small business owners play in gray areas and less-than-gray areas with respect to what they deduct.

Hypothetically speaking, you could deduct a PS5 for a business. There are some businesses for which a PS5 is necessary. For example, if you are in the business of doing video game reviews – which people pay money for – and you only use the PS5 to do the reviews for the business, then that's necessary and customary for your business. I was in the software industry. It is not necessary or customary to have a PS5 to just operate in the software industry.

In the actual mechanics of running an online business, you will likely have some expenses that are like, “It's a little bit for me as a person and it's a little bit for the business.” A classic example of this is your internet connection. You can't do your work as an internet writer without an internet connection. But presumably, you also use that internet connection to do personal emails.

What you're going to do is prorate it. That means that if I spend 16 hours a day attached to a screen, which is unfortunately kind of close to accurate, and about 8 of that is for my business and about 8 of that is for me, then about 50% of the internet bill every month will be prorated to yours truly and 50% will be prorated to the business. Your bookkeeper or accountant can help you set this up. And again, have great records of what you actually spent.

There are a few types of business expenses that the IRS thinks are extremely abused, so they require you to have more substantiation than usual. Those are business meals and entertainment, travel, and home offices. If you're going to deduct any of these, talk to your accountant, and/or read the IRS's publication for small businesses, which is impressively readable – they write it at a fifth grade reading level, and it's actually kind of good – and follow their instructions.

There are a lot of things that might not feel like they're necessarily business expenses but totally are. For example, other reading that you do as research for the kind of writing that you do, like other Substacks and books that you read.

There are a lot of things that might not feel like they're necessarily business expenses but totally are. For example, other reading that you do as research for the kind of writing that you do, like other Substacks and books that you read. Talk to your accountant – there is a high likelihood that those are necessary and customary in the profession you find yourself going after.

Finding an insurance policy

With insurance and legal stuff, again, I'm not your lawyer – this is advice to help a “younger me” sleep better through a few stressful nights over 15 years.

The first time I did business on the internet, I was terrified that I was going to make somebody mad, and they were going to sue me and I was going to have my retirement account taken away from me.

A fun thing about regulated industries like insurance is that they have to tell the government exactly what the cost structure of their product is. And so, they will tell the government how likely it is for small businesses to get sued. So, I went into the insurance filings for the Florida Department of Insurance, for the Berkshire Hathaway subsidiary that gave me my professional insurance policy.

I figured exactly how likely I was to get sued when I had my insurance policy. Here's what they told the government: 0.78% of all people who were in a similar situation to me were sued in any given year. It was a $42,000 average expense. When I looked at those two numbers, I was like, “That was much less risky and much less catastrophic than I thought it was when I was running a business. Good to know.”

But if, hypothetically, you get sued, you are in for months upon months of sleepless nights. So at some point, you should probably think of getting an insurance policy.

The specific kind of policy you want is a blended, general liability policy and either professional liability or errors of insurance. You don't have to remember that. It's going to be the exact thing that everybody tries to set you up with when you say, “Hey, I'm a business, I want insurance. What is the basic thing?”

I don't have a particular recommendation on which provider you go through. Because insurance is crazy, they don't actually sell you insurance directly; they make you go through a broker. If you Google “blogger insurance,” you will find plenty of great options.

With legal issues, you're winging it in the early days. Early in life of your business, the only thing that I would worry about is if you're in a line of work where you're likely to get what's called the California SLAPP: Strategic Lawsuit Against Public Participation. If you're covering government corruption or getting deep into the weeds with deep pocketed business interests, and then you might want to get liability insurance earlier rather than later.

At the point where this is your full-time job, it's too cheap to lose sleep over. Just outsource the risk to [your insurance policy].

At the point where this is your full-time job, it's too cheap to lose sleep over. Just outsource the risk to [your insurance policy]. And when it's a business, you'll probably want to have a lawyer on retainer, just so that you can have a “sleep better at night” call every quarter.

If you use Stripe Atlas to form an LLC, you can use this link to get $250 off your registration.