This week, we interviewed James Tate, who writes Roaring 20s by Tate, a publication exploring weekly financial news as it happened exactly 100 years ago.

This interview has been lightly edited for length and clarity.

What’s your Substack about in one sentence?

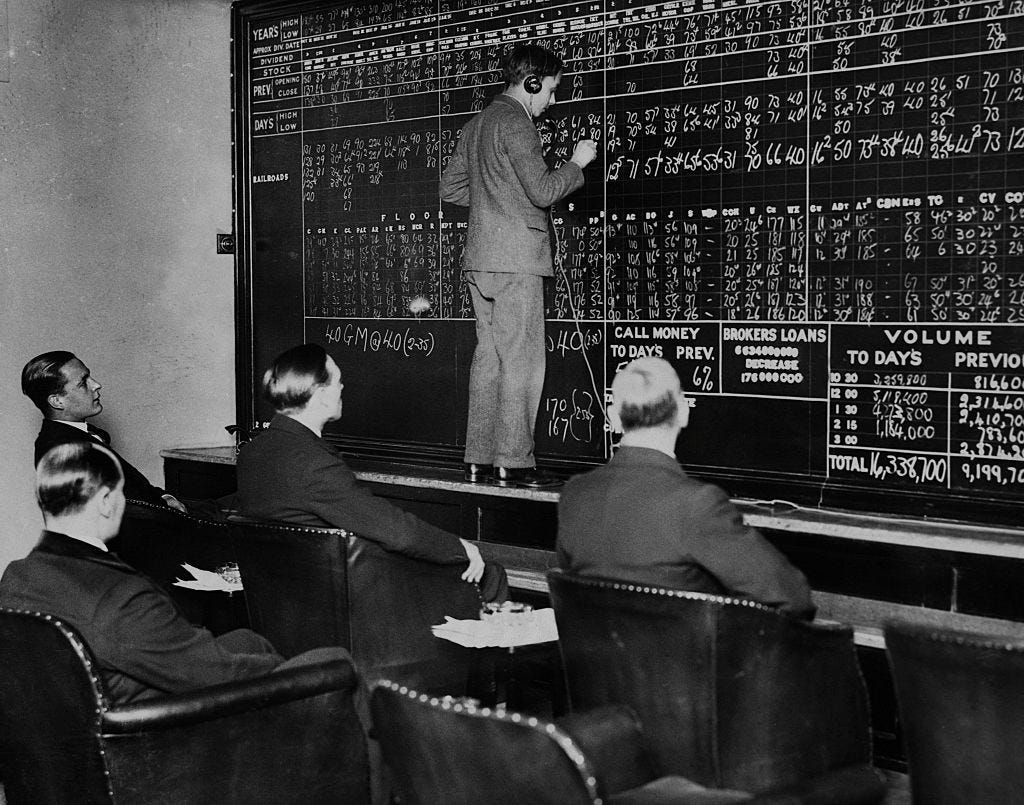

I'm reading the Financial Times and Wall Street Journal from 100 years ago each week leading up to 1929.

What motivated you to start a publication about financial markets? What fascinates you about them?

Stock markets are the defining human mood barometer. At any time in the past 150 years, you can look at financial markets and determine the mood of a nation: bullish or bearish. It’s the pulse of humanity. I was tapping out notes from old finance rags and magazines to a select group of friends every month or so, and some of them mentioned that others might be interested.

Why focus on this era of financial history specifically?

Everyone is familiar with the 1920s. That decade is synonymous with boom and bust, and I also think there are many learnings from the 1920s that can be applied to today’s investor. It’s the first decade in human history when financial markets went mainstream.

What's your process for writing these posts?

During the pandemic lockdowns, most libraries made newspaper and magazine archives available to everyone. Every post begins with a thorough reading of the papers 100 years ago that week. I want to take a fresh view without distractions, so I typically spend half a day – usually Friday afternoon or Saturday morning – drafting and revising a few times.

My knowledge of market history spans from 1870 to the present day, so I can decide what’s relevant back then for today’s readers. Some events that seemed insignificant in 1921 ended up bending history meaningfully, such as German reparations that steadily go from front-page news to back-page news.

What's changed about financial journalism in the last 100 years?

Financial journalism was much sparser in 1921. I make the point in the introductory post that the average page count of both the WSJ and FT was about 10 pages throughout the 1920s. Today, both papers are easily five times that size. The professionalization and globalization of companies is a very new phenomenon that started in the 1960s and 1970s. The WSJ and FT of the 1970s would be familiar to readers today.

While the level of journalism was different in 1921, market coverage is similar. Several market mechanics were known to the 1920s investor. Bull and bear markets, dividend yields, and earnings were understood. Most equity investors invested solely for dividends instead of share price appreciation. Hence, what transpired in the 1920s excited people. When my great-grandmother, born in 1912, was alive, she spoke about that as the first decade where people learned that stock prices could appreciate rather than just pay dividends and go sideways.

What has been the most surprising insight so far as you've read and researched these old financial writings?

We’re only at the beginning of the 1921-1929 bull market in this newsletter, and what’s absolutely astounding is that, just as today, nobody knows the future.

The early 1920s started slowly. There was a terrible recession from 1920 to 1921, and important figures in the business world thought bonds would outperform stocks in the 1920s. Government officials, such as Treasury Secretary Andrew Mellon, and professional investors, such as financier Otto Kahn, recommended that average investors stick with bonds, yielding about 5%, instead of rotating to equities. The fact that the 1920s behaved more like the 1990s than the 1970s was not apparent in 1921.

Today, it’s common to see professional analysts in the media draw up conclusions and forecasts about which asset classes – even broken down to granular levels – will outperform. The truth is, there are too many variables at play [to say]. But prognosticating on the future makes great ratings! The 2020s could see markets do anything.

Who’s another Substack writer you’d recommend?

Noah Smith’s Noahpinion. I enjoy Noah’s take on business and financial news. His high-quality, crisp analysis covers a lot of ground in a short amount of writing.

Subscribe to James’s newsletter, Roaring 20s by Tate, and follow him on Twitter.